fees with surcharging

Programs designed to save you money and follow the proper rules.

What is Surcharging?

Surcharging, often referred to as “checkout fee,” is an additional cost merchants often add to the listed price of goods or services for credit card purchases to delegate the fees incurred by accepting credit cards to their customers.

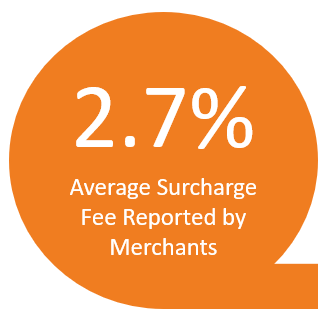

Economic issues and limitations caused by the pandemic have increased the hardships faced by both merchants and consumers, as a result we see an increased popularity in surcharging with (23%) of merchants reporting they used surcharging to offset card processing fees. Those who did charged their customers an average fee of 2.7%

What do Customers Think?

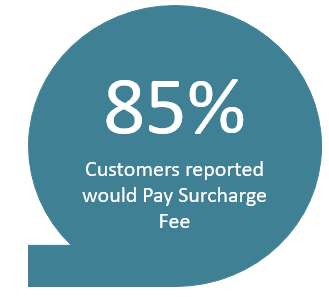

A survey of consumers conducted in Nov. 2021, found that (50%) of consumers reported paying a surcharge fee at least once. Approximately, (85%) reported paying when presented a surcharge fee.